Table of Content

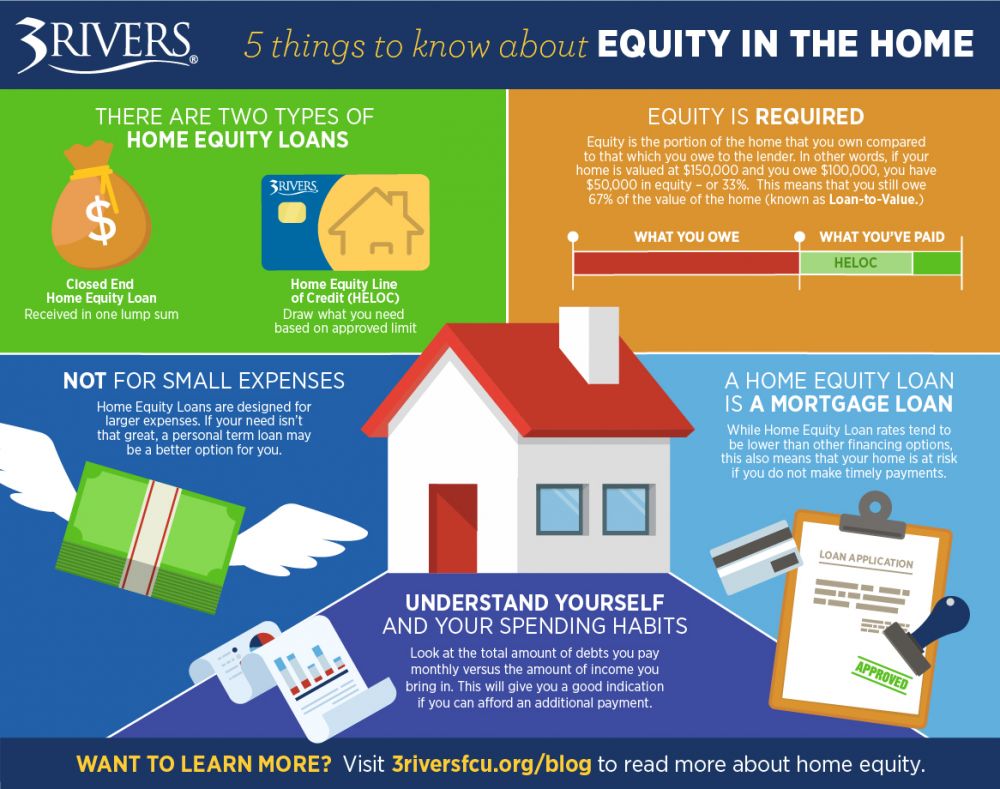

The rate with a HELOC will most often be variable, making it a bit riskier than the other options in this regard. It is also common to overdraw a bit with a HELOC and incur harder-to-handle payments of interest-and-principal. This tool estimates how much equity you have built up in your home. Because most credit cards have a variable interest rate, they can be riskier than fixed-rate loans. The good news, however, is that you only pay interest on what you borrow and can reuse that available credit once it’s repaid. Watch out for annual fees and other account-related charges, though.

You could use some of your equity as a down payment to purchase an investment property, which could be used to host Airbnb guests or rent to long-term tenants, building a passive income stream. Keep in mind there may also be a minimum borrowing amount to make underwriting the loan worth your lender’s time and effort. If your existing LTV ratio is above 85%, you can be considered a high-LTV borrower. For example, if the LTV ratio on your first mortgage is 85% and you’re looking to borrow from your available equity, the additional loan you’re applying for would be considered a high-LTV loan. To qualify for a home equity loan, in many cases your loan-to-value ratio shouldn’t exceed 85%. However, it’s possible to get a high-LTV home equity loan that allows you to borrow up to 100% of your home’s value.

HELOC | VA Home Equity Loan | Credit Union Line of Credit

But as long as you make debt repayments on time, you can recover from that initial hit quickly. Lenders typically offer homeowners a maximum of an 80% to 85% LTV, though they may decide to offer people with good credit scores loans with an LTV as high as 100%. Typically banks compensate for a lower equity buffer by charging a higher rate of interest. With a home equity loan, you can borrow up to 95% of your home's value and lock in a low fixed interest rate. A home equity line of credit is a revolving line of credit with a variable rate that you can access at any time, for any amount up to your approved limit.

This provides the stability of a fixed monthly payment. You won’t have to worry about your payments becoming unaffordable later. Some lenders, such as Arsenal Credit Union and Signature Federal Credit Union, offer 100% LTV home equity loans. Arsenal offers no-closing-cost loans, while Signature Federal offers closing costs savings of up to $1,000.

Is a home equity line of credit right for you?

Typically, the interest rate will be based on an index rate plus a personalized markup that is based on factors like credit score and debt obligations. If you’re perceived as a low-risk borrower, your rate will be lower. It’s a second loan secured by your equity in the house—the current value of the property minus what you still owe. Unless your home is paid for, you’ll have two payments to make. But, depending on the amount you borrow, your HELOC payment can be very low. Even if you’re approved for a large amount of credit, you’ll only be paying on the funds that you actually borrow.

College is another big-ticket item that can be difficult to estimate ahead of time. Most parents have no idea what the final bill of the semester is going to look like or how much they should set aside for dorm furniture, spending money, and travel expenses. Having access to a large amount of credit at a reasonable rate can be a tremendous comfort during the college years.

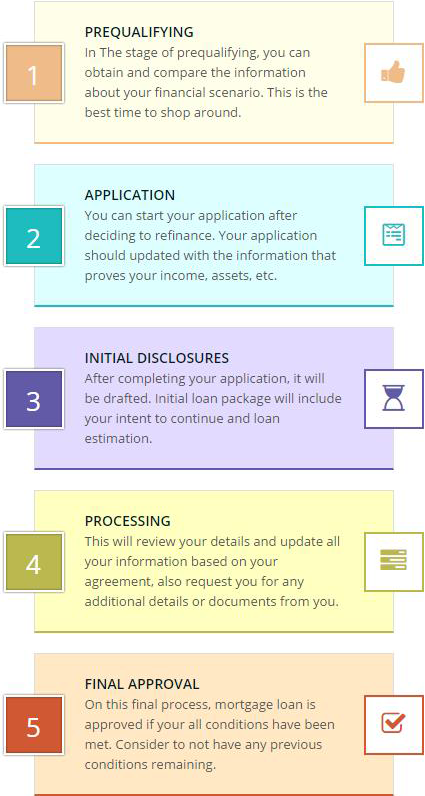

How to Get a Second Mortgage Online

The actual amount you can access depends on a variety of factors—like your lender and your home. Here at Lower, we offer a HELOC up to 95% loan-to-value while the industry standard is only 80%. The difference between 80% and 95% LTV can increase the amount you can access by tens of thousands of dollars. Andrea Riquier is a New York-based writer covering mortgages and the housing market for Forbes Advisor. She was previously at Dow Jones MarketWatch, on the housing market and financial markets beats. Before that, she covered macro and central banks for Investor's Business Daily, and municipal bonds for Debtwire.

Home equity loans are another way to leverage the equity you have in your home. They are taken out for a set amount and paid back on a regular basis, according to a fixed interest rate. That may make lines of credit less appealing now, as the Federal Reserve embarks on a cycle of raising interest rates several times over the next few months and years. HELOCs and home equity loans are typically approved in a 2 to 4 week period, with the approval process rarely taking more than 6 weeks. Home equity loans are more flexible than refinancing because the rules are not as restrictive.

Your home equity is the difference between what your home is worth and what you owe on any mortgage loans taken out to pay for it. To calculate it, simply subtract the balances of any outstanding loans from your home’s appraised value. The number you get is your ownership stake in the home. The short answer is yes, you can get a high-LTV home equity loan. Your LTV ratio represents the percentage of your home’s value being financed by a first and/or second mortgage. Generally speaking, you may borrow against your home if you have built at least 15% equity.

In an effort to keep your personal information confidential, we will not be storing this application's information after the application has been inactive for more than 10 minutes. Because you will have to start your application from the beginning after more than 10 minutes of inactivity, please plan accordingly when completing this application. SDFCU partners with TruStage Auto & Home Insurance to provide you with a discounted property and casualty coverage solution. Tap into the equity of your home to consolidate high-interest debt, fund a home improvement project, and more. Choose from a Home Equity Loan or a Home Equity Line of Credit.

However, each lender is free to set its own requirements, and may set a higher credit minimum for high LTV loans. AN LTV RATIO UNDER 85% Your LTV ratio is a key factor in qualifying for a home equity loan. Standard guidelines might require a maximum 85% LTV ratio, but if you’re looking to borrow up to a 100% LTV home equity loan, take the time to shop around. You may be able to find the loan you need, just be prepared to pay higher interest rates. Still, if you’re taking out a home equity loan without paying closing costs, you may be on the hook for those costs if you pay off and close the loan within three years, or sometimes in less time.

Borrowers who obtain a conventional mortgage and put less than 20% down are often required to pay for property mortgage insurance . This is a monthly fee which is in addition to the typical loan payment. The insurance policy protects the lender's interests in the case of default. Please be aware that this is not an advertisement for credit. Nothing on this site contains an offer to make a specific home loan for any purpose with any specific terms. This is a web-site and no loans can be guaranteed as loans and rates are subject to change.

No comments:

Post a Comment